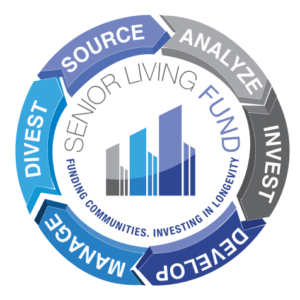

EACH SENIOR LIVING DEVELOPMENT IS CAREFULLY EVALUATED & VETTED

A detailed examination of all the risk elements are evaluated, managed and mitigated.

Market demand, facility design & construction, location intelligence, operations management, financial reserves, sound economics/business model and an executable exit strategy all must be present before any senior living development project is considered. Senior Living Fund gives investors insider access to these pre-vetted developments.

Senior Living as an asset class has been historically difficult for average investors to access until now. Institutional investors and specialized operators have been the primary beneficiaries concentrating on an asset class whose demand has been driven by major demographic trends. Now astute individual investors can also capitalize on these trends and earn strong yields in a proven niche.

On a national macro level the demographic trends are clear. The rapidly aging population is fueling demand for senior living facilities that are in short supply. This is the main driver for growth and why senior living has continuously proven to be a strong asset class regardless of the condition of the overall economy.

On a micro level a much more detailed Due Diligence process takes place on each and every project to ensure every new senior living development is a success for investors and residents alike. The projected returns of 10% – 16% are exceptional given the relative low risk of the investment.

Reference : https://seniorlivingfund.com/